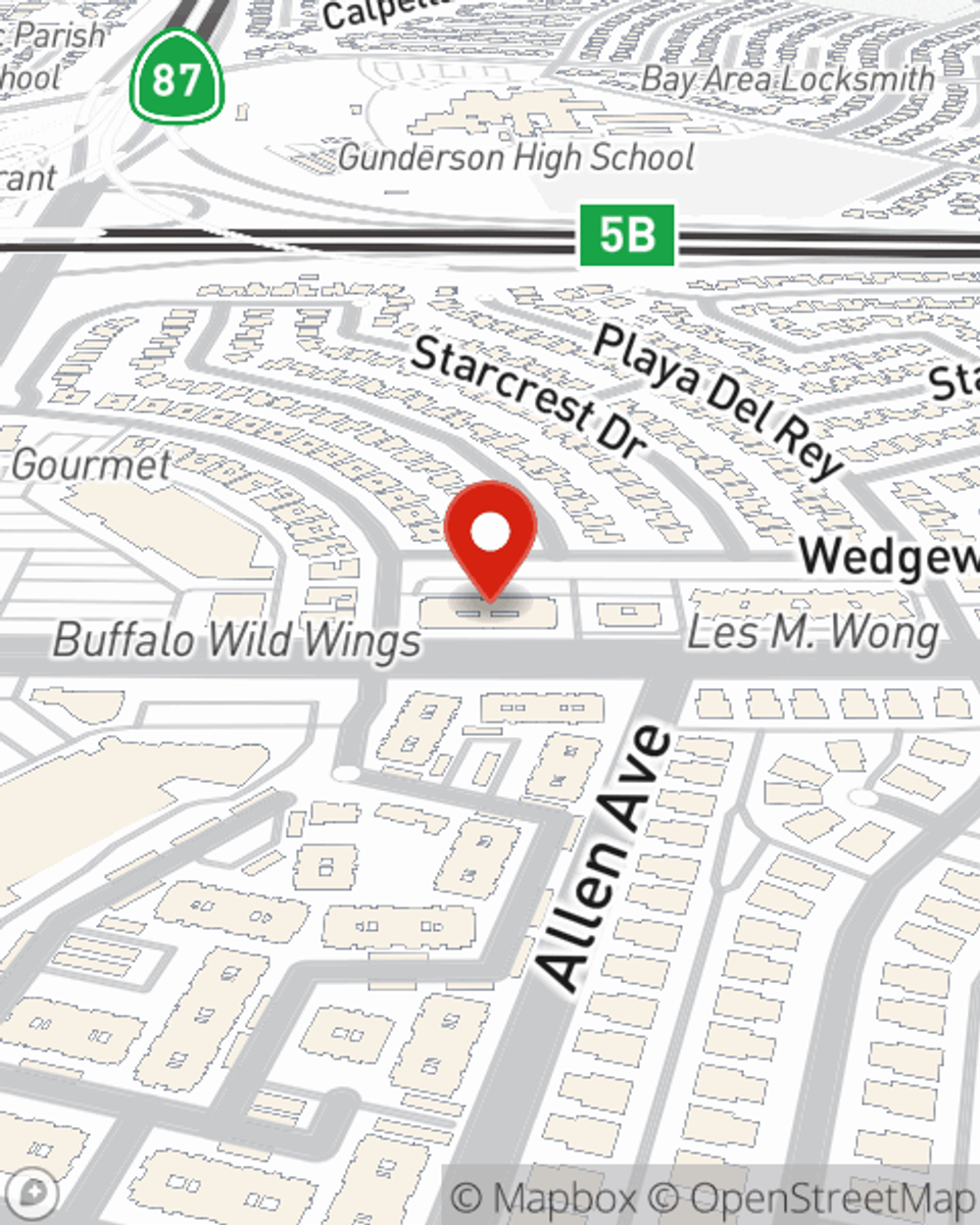

Business Insurance in and around San Jose

Get your San Jose business covered, right here!

Insure your business, intentionally

- Silicon Valley

- SF Bay Area

- California

- San Jose

- Los Gatos

- Campbell

- Morgan Hill

- Gilroy

- Los Angeles

- Palm Springs

- San Diego

- Monterey & Carmel

- Saratoga

- Monte Sereno

Cost Effective Insurance For Your Business.

Whether you own a a stained glass shop, a hearing aid store, or a home improvement store, State Farm has small business insurance that can help. That way, amid all the different moving pieces and decisions, you can focus on navigating the ups and downs of being a business owner.

Get your San Jose business covered, right here!

Insure your business, intentionally

Customizable Coverage For Your Business

The passion you have to serve your customers is a great foundation. When you add business insurance from State Farm, you can be ready for the challenges ahead. That’s why entrepreneurs and business owners turn to State Farm Agent Steve Sosnowski. With an agent like Steve Sosnowski, your coverage can include great options, such as artisan and service contractors, business owners policies and commercial liability umbrella policies.

Let's chat about business! Call Steve Sosnowski today to discover why State Farm has been rated one of the top overall choices for insurance coverage by small businesses like yours.

Simple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Steve Sosnowski

State Farm® Insurance AgentSimple Insights®

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.